nh property tax rates by town 2019

2021Town Tax Rate358School Tax Rate - LOCAL1332School Tax Rate - STATE173County Tax Rate079TOTAL1942 2020 Town Tax Rate335 School Tax Rate - LOCAL1291 School Tax Rate - STATE170 County Tax Rate080TOTAL1876Median Ratio 1002 2019Town Tax Rate449School Tax Rate - LOCAL1479Scho. 2021 2020 2019 2018 2017 2016.

2022 Property Taxes By State Report Propertyshark

Tax Rate and Ratio History.

. Find All The Record Information You Need Here. All documents have been saved in Portable Document Format unless otherwise indicated. City Tax Rates Total Rate Sort ascending County.

The NH DRA has set and certified the 2019 Tax Rate at 2638. 2020Tax Rate Per Thousand Assessed Value. The bills are printed and will be mailed to the property owner of record and are due on December 9th 2019.

2622 2021Tax Rate2020Tax Rate2019Tax Rate2018Tax Rate2017Tax Rate2016Tax Rate2015Tax Rate2014Tax Rate Town TaxLocal School TaxState Educ. If you pay in person please bring your entire bill and well stamp one copy paid. State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during the COVID-19 pandemic.

Tax Rate Gross Tax Levy Levy Per Capita 1 2022. Benedict officially the County of San Benito is a county located in the Coast Range Mountains of the US. Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090.

Unsure Of The Value Of Your Property. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098. 100 rows 2019 NH Property Tax Rates Map 15 15 to 25 25 For more tax information about each area.

No Inventory List of Towns NOT Using the PA-28. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. Ad Find County Online Property Taxes Info From 2022.

Understanding NH Property Taxes. 2131 2848 2696 2723 2601 2510 947 Revaluation Year Values Increased 786 838 882 911 966 Revaluation Year Values Increased 2015. Comma Separated Values csv format.

14 rows Rate Assessed Ratio. The Town portion of the tax rate remained constant at 657. Property Tax Year is April 1 to March 31.

Property tax bills are issued twice a year in Allenstown usually due on July 1st and December 1st of each year. Free Excel reader from Microsoft. 63 rows New Hampshire Property Tax Rates 15 15 to 25 25 to 30 30 Tap or click markers on the map below.

Visit nhgov for a list of free csv readers for a variety of operating systems. Current 2021 tax rate. 2020 NH Property Tax Rates.

New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. This is followed by Berlin with the second highest property tax rate in New Hampshire with a property tax rate of 3654 followed by Gorham with a property tax rate of 356.

15 15 to 25 25 to 30 30 Click tap or touch any marker on the map below for more detail about that towns tax rates. November 4 2019 - 845am. However the actual tax year runs from April 1st.

Values Determined as of April 1st each year. 3150 per 1000 of property valuation 2022 tax rate will be issued in Fall of 2022 To check your proposed new 2022 assessed value online Click here. 2648 95 2014.

Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year.

Real Estate Real Estate Estates Bobvila Com

These Are The Best And Worst States For Taxes In 2019

Which Racial Group Is Most Likely To Be Killed By Police When Unarmed By State Racial Groups Killed By Police Police

How Do State And Local Sales Taxes Work Tax Policy Center

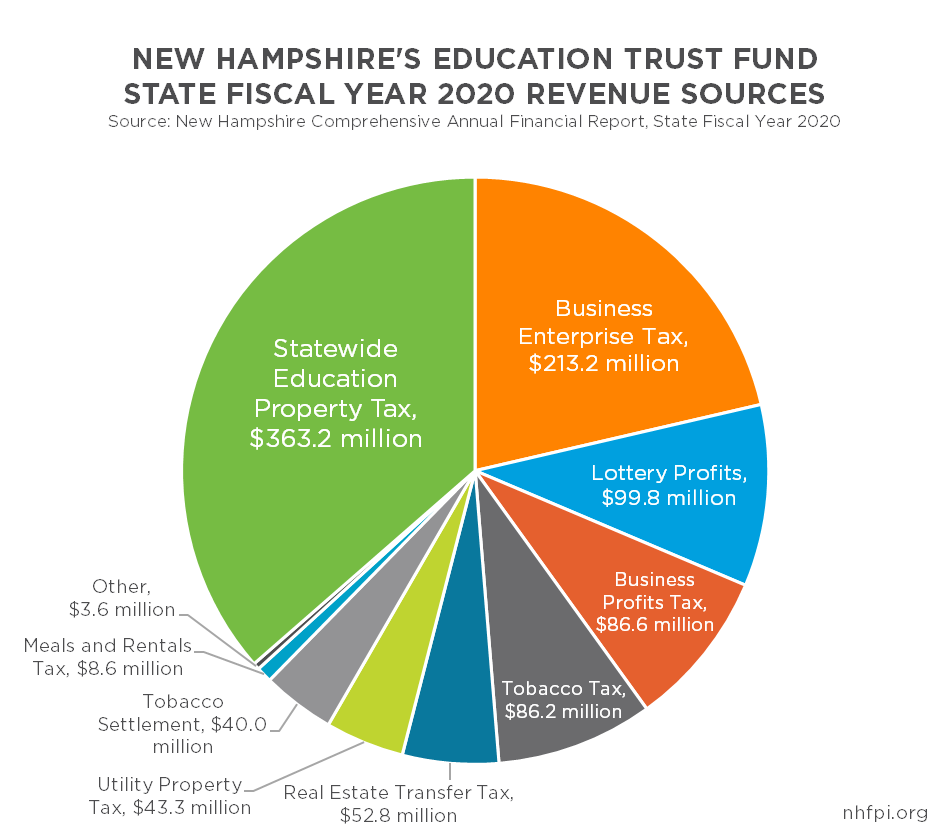

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Her Story 13 Books By Women That Real Estate Pros Recommend In 2022 Real Estate Information Real Estate News Real Estate

Curious What Your Home Is Worth Take Advantage Of Our Sellertools To Find Out What Your Home Is Worth In Today North Carolina Homes Next At Home Real Estate

State By State Guide To Taxes On Retirees Kiplinger

These Are The 10 Best States To Raise A Family In America For 2019 Homesnacks States In America America Education Level

Tree Height Maps Vivid Maps Map Temperate Rainforest Tree

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only Sta Inheritance Tax Estate Tax Inheritance

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Understanding New Hampshire Taxes Free State Project

Property Taxes By State County Lowest Property Taxes In The Us Mapped

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation